If you’re not familiar with the process or language in the form, signing a lien waiver can be scary. Fortunately, California’s lien waiver rules are clearly spelled out in the law. This is a step-by-step guide to completing California’s Conditional Lien Waiver on Final Payment.

California’s mechanics lien statute provides the exact language required on each type of lien waiver form, so there’s no confusion about what you’re signing.

Want to fill out and exchange your lien waiver as quickly and painlessly as possible? Send one through Levelset’s easy-to-use platform.

Prefer to do it yourself? Download the California Unconditional Waiver & Release on Progress Payment form, and keep reading. We’ll walk you through each part of the form.

Table of Contents

Before starting to fill out this form, you should first confirm that you’re working on the right form. As we explored in The Ultimate Guide to California Lien Waivers, California has regulated lien waiver forms, and there are 4 different document templates that can be used on a project.

Figuring out which template to use is actually quite easy. You just need to ask yourself two questions.

This is the guide for California’s Conditional Final Lien Waiver. This means you should exchange this waiver if:

The Conditional Waiver and Release on Final Payment form is used when the claimant is required to execute a waiver in exchange for a final payment. Because it is conditional, this release is only binding if there is evidence of payment.

Release On Final Payment - form preview" width="653" height="842" />

Release On Final Payment - form preview" width="653" height="842" />

Download the Conditional Waiver and Release on Final Payment form, prepared by construction attorneys to meet the statutory requirements.

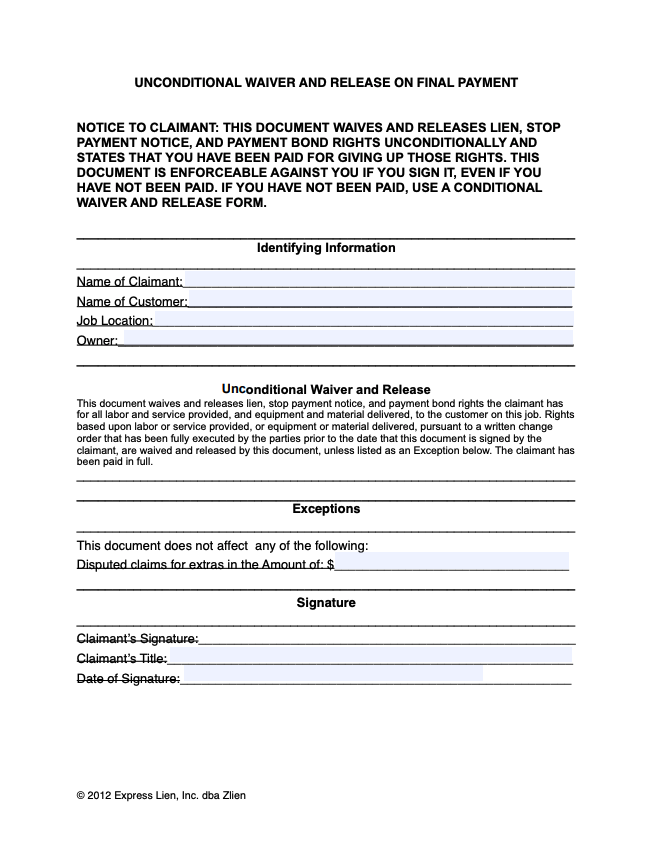

Now it’s time to go through each field of this waiver form. Here is a field-by-field breakdown of this form:

This is the name the party to be paid, and the party who will be signing the lien waiver document. Identify the name of this party correctly. This seem obvious, but incorrectly spelled company names and misidentifying the company – using Inc. when it should be LLC, etc., or referring to a DBA incorrectly – is extremely common. See: 3 Mistakes When Claimants Make When Identifying Themselves.

This is the name of the party who hired the claimant, and usually, the name of the party who will actually be making the payment. It’s possible that the party making the payment is not the “name of customer.” For example, if a property owner (paying party) is making payment directly to a subcontractor (name of claimant). In this instance, the “name of the customer” would be the general contractor. This scenario is typical when the parties are paying with joint checks.

This is the physical place where the work was performed or where the materials were incorporated into the project (i.e. not where the materials were shipped!). There are a lot of very strict requirements when identifying the job location in a mechanics lien claim, but the requirements here are much more relaxed. A physical address will suffice.

This field should identify the property owner(s). Again, while this is pretty straight-forward, nuances about ownership could cause confusion. Here are some suggestions in common complex ownership scenarios:

If the payment is being made by ACH, credit card, or something other than check this may seem a little confusing. Use common sense. In every case, there is a “paying party,” and that is the party who should be identified here.

This is the dollar amount of the payment. If payment is being made by ACH, credit card, or something other than a check, use common sense, and just enter the amount of the payment in this field.

This field can be a little more confusing than the “maker of the check” and “amount of the check” fields, especially for payments made electronically or through some other payment method (i.e. cash!). Ultimately this field should list the party receiving payment. It’s possible that more than one party can receive the same payment, as is the case with joint checks, and in that instance, you’ll want to put all parties here who are listed on the check.

Unlike the “progress payment” lien waivers in California, the final payment waivers like this one do not include certain exceptions by default. Progress payment waivers exclude retention or retainage from the waiver, as well as “extras for which the claimant has not received payment,” and “contract rights.” In this final payment waiver, all of this stuff is waived as a default. Therefore, if you want to exclude absolutely anything, you need to put it in this section of the waiver. The final waiver gives two areas for this:

This is the signature of the individual signing the document on behalf of the claimant. You can e-sign this, as we explored in “Can You Electronically Sign A Lien Waiver?“

This field should list the job title or role of the individual signing the document.

This is simply the calendar date that the document is signed. Don’t mess this one up!

Congratulations! You’ve reached the end of the California Conditional Waiver and Release on Final Payment.

You may be wondering — hey, what about getting this thing notarized? While it is surprisingly common in the construction payment culture to have lien waivers notarized, this is very rarely required, and it is not a requirement in California (see: Do California Lien Waivers Need To Be Notarized?). In fact, since California’s lien waivers are regulated and must follow a certain format, and that format does not have notarization, there’s a decent argument that asking for and/or providing notarization may make the waiver illegal!

Sending, receiving, requesting, and tracking lien waivers can be a real hassle, and a lot of various questions can pop up when going through this process.

Here are some questions (and expert answers) asked about California lien waivers from people like you:

We’re the Lien Waiver experts. With us it’s fast, easy, free, and done right.

Hopefully, this guide has clarified the California Conditional Waiver and Release on Final Payment form and its requirements.

Lien waivers are often overlooked but carry significant legal consequences. It is extremely important to understand the California lien waiver’s significance and to utilize the tools and resources that are available to you.

For more guidance with California lien waivers check out Levelset’s guide to the other 3 lien waiver forms in California:

![Guide To California's Conditional Lien Waiver -- Final Payment [Free Download]](https://www.levelset.com/wp-content/uploads/2019/04/california-conditional-waiver-final-payment-guide.jpg)

The California conditional lien waiver for final payment is one of four lien waivers that can be exchanged. Learn when you should send this waiver.