BBC British Broadcasting Corporation CAVCO Canadian Audio-Visual Certification Office CMF Canada Media Fund CPA Chartered Professional Accountant CPTC Canadian Film or Video Production Tax Credit CRA Canada Revenue Agency CRTC Canadian Radio-television and Telecommunications Commission DG Director General DVD Digital Versatile Disc PSTC Film or Video Production Services Tax Credit VOD Video on Demand VR Virtual Reality

The Canadian Film or Video Production Tax Credit (CPTC) is a refundable corporate tax credit designed to encourage the creation of Canadian film and television programming and the development of an active domestic independent production sector in Canada. The CPTC program is jointly administered by the Department of Canadian Heritage, through the Canadian Audio-Visual Certification Office (CAVCO), and by the Canada Revenue Agency (CRA).

The CPTC is governed by section 125.4 of the Income Tax Act (the “Act”) and section 1106 of the Income Tax Regulations (the “Regulations”). Links to the full text of the Act and Regulations are available on CAVCO’s website. Footnote 1 The Act and Regulations take precedence, to the extent of any inconsistency with these guidelines.

These guidelines focus on the requirements a production must meet to be certified as a Canadian film or video production under the CPTC program.

They also explain how the tax credit for a production is calculated, and the CRA’s role in reviewing claims for the tax credit following the certification of a production through CAVCO.

The CPTC is available only to a Canadian production company that is a qualified corporation. A qualified corporation is one that is throughout a given taxation year a prescribed taxable Canadian corporation with a permanent establishment in Canada, and that primarily carries on the activities of a Canadian film or video production business. A Canadian film or video production in this context is a production meeting the requirements of section 1106 of the Regulations.

Applications for CPTC certification must be submitted through the CAVCO Online application system. See CAVCO’s website for more information.

Production companies must apply to CAVCO for both a Canadian film or video production certificate (Part A certificate) and a certificate of completion (Part B certificate) for each production.

The CPTC is available at the rate of 25% of the qualified labour expenditure for an eligible production in a given taxation year.

The qualified labour expenditure represents the eligible labour expenses incurred for a production, capped at 60% of the production’s total cost once funding amounts considered assistance are deducted. The maximum CPTC available for a production is therefore 15% of the total cost of production net of assistance. The rules for calculating the tax credit are set out in section 125.4 of the Act.

To be eligible for CPTC certification, a production must be a linear, non-interactive film or video production.

An interactive project requiring some form of viewer intervention to progress the storyline is not eligible. A 360/virtual reality (VR) production can be eligible, as long as the storyline progresses in a linear way without needing any active viewer intervention. Viewer involvement outside of the context of the audiovisual project – for example, through online voting – is acceptable.

Websites, games, apps, and any similar products are not eligible for the CPTC.

The PSTC is the other federal audiovisual tax credit program co-administered by CAVCO and the CRA. It promotes Canada as a location of choice for foreign- and Canadian-owned film and television productions and supports the existence of a production infrastructure of international calibre in Canada.

It is available to Canadian-based production companies or production service companies at a rate of 16% of the qualified Canadian labour expenditure for a production. The qualified Canadian labour expenditure is equal to all eligible labour expenses (expenses payable to Canadian residents for services rendered in Canada) minus the total of all financing amounts considered assistance.

Productions eligible for the PSTC generally feature non-Canadian creative control and non-Canadian copyright ownership.

For more information on PSTC program requirements, see CAVCO’s website.

Note that a corporation cannot receive both the PSTC and the CPTC for the same production.

For a production to be eligible under the CPTC program, it must meet all of the requirements set out below. Each is further described in the noted section of the guidelines. These requirements are found in section 125.4 of the Act and section 1106 of the Regulations, under the definitions for “Canadian film or video production,” “Canadian film or video production certificate” and “excluded production.”

Note that requirements 3, 5-8 and 11 do not apply to treaty coproductions.

A treaty coproduction must meet all other requirements, and must conform to the terms of the applicable coproduction treaty. See Chapter 5 for more information on the certification of treaty coproductions under the CPTC program.

Information relevant to the CPTC program, including program guidelines, forms, and the online application portal, is available on CAVCO’s website.

Contact information:

Canadian Audio-Visual Certification Office (CAVCO)

Canadian Heritage

25 Eddy Street

Gatineau, Quebec

J8X 4B5

Telephone: 1-888-433-2200 (toll-free) Fax: 1-819-934-8958 TTY : 1-888-997-3123 E-mail: bcpac-cavco@pch.gc.ca Website: canada.ca/cavco

On behalf of the Minister of Canadian Heritage, CAVCO issues certificates for productions meeting all certification requirements under the CPTC program. (See section 1.03)

Production companies submit these certificates to the Canada Revenue Agency (CRA), as part of their T2 Corporation Income Tax Returns, to receive the tax credit. (See section 1.04)

CAVCO is responsible for assessing whether a production meets the requirements for CPTC certification set out in section 125.4 of the Act and section 1106 of the Regulations. CAVCO then recommends to the Minister of Canadian Heritage whether or not to issue a “Canadian film or video production certificate” (a “Part A certificate”) for the production. Footnote 2

Once a production is completed, CAVCO is responsible for assessing whether the production continues to meet the requirements of the Act and Regulations. CAVCO recommends to the Minister whether or not to issue a “certificate of completion” (a “Part B certificate”) for the production. A production for which a certificate of completion is not issued loses its status as a Canadian film or video production. More information on each certificate can be found in sections 1.03.02-1.03.03.

A previously issued Part A certificate may be revoked by the Minister of Canadian Heritage if an omission or incorrect statement was made for the purpose of obtaining the certificate, or where, for any reason, the production is found not to be a Canadian film or video production. A revoked certificate is deemed never to have been issued. See section 1.11 for more information on revocations.

This certificate confirms that a production is a “Canadian film or video production.”

The certificate also provides estimates of the production costs and labour expenditures associated with a production, as well as the tax credit applicable to the production. These estimates are based on an analysis of budget and financing information for the production.

The Part A certificate is generally issued before or during production, to help production companies secure other production financing and to allow them to claim a tax credit at the end of the first year of production. Note that it is not necessary for a production company to have received both the Part A and Part B certificates before applying for the tax credit with the CRA. A claim can be filed with just the Part A certificate.

If CAVCO cannot conclusively determine whether one or more types of financing for a production are assistance (see section 7.06), this financing will be treated as assistance for the purpose of CAVCO’s estimate of the tax credit for the production.

The estimate provided by CAVCO is not binding on the CRA, and is not a commitment as to the final value of the tax credit. A final determination of the qualified labour expenditure and tax credit for a production is made by the CRA during its review of a tax credit claim for a given year.

A Part B certificate is issued where a production is completed and continues to meet the requirements for being certified under the CPTC program. If this certificate is not issued within the prescribed time frame (see section 1.09), the CRA will refuse any tax credit claim for the production and reassess the corporation’s tax returns for any tax credit previously allowed. Footnote 3

An applicant may apply at the same time (with a “Part A/B application”) for both the Canadian film or video production certificate and the certificate of completion, once a production is completed.

For the purpose of CPTC certification, each episode in a series or mini-series, or film in an anthology of short films, is considered a distinct production. Footnote 4 If an application to CAVCO is for a series, only one certificate is issued, with the suffix of the certificate number indicating the total number of eligible episodes. For example, 45678-010 means that 10 episodes have been certified.

The CRA is responsible for:

To claim the tax credit for a certified production, a qualified corporation must file with its T2 Corporation Income Tax Return:

CAVCO informs the CRA if, for any reason, a Part B certificate is not subsequently issued for the production. As previously noted, the CRA will in these cases refuse any new tax credit claim for the production and reassess the corporation’s tax returns for any tax credit previously allowed.

The CPTC is a refundable tax credit. This means that the qualified corporation will be refunded the amount of the tax credit, to the extent that it exceeds the total of any tax payable for the year, and subject to the CRA’s right to offset any other amount the corporation owes.

Note that under subsection 164(1) of the Act, a tax credit for a given taxation year can only be issued in the form of a refund if the T2 Corporation Income Tax Return for that year was filed within three years of the end of that year.

As part of its review of a tax credit claim, the CRA may request any additional information it deems necessary, including in the course of a full fiscal audit of the production. This may include, but is not limited to, the books and records of the corporation and the full applications filed with CAVCO.

More information on the CRA’s role in co-administering the CPTC program, as well as its Form T1131 and its publication Canadian Film or Video Production Tax Credit – Guide to Form T1131 , can be found on its website.

A CPTC-certified production is a Class 10(x) property under Schedule II of the Income Tax Regulations , and is eligible for an accelerated Capital Cost Allowance (CCA). For more information, see the CRA website or contact the applicable regional CRA Film Services Unit.

Treaty coproductions involving a Canadian production company can be eligible for the CPTC.

For a treaty coproduction to be considered a Canadian film or video production, the Canadian production company coproducing it must apply to Telefilm Canada (Telefilm) for Preliminary and Final Recommendations, as well as to CAVCO for a Part A certificate and a Part B certificate.

Telefilm is the administrative authority responsible for evaluating whether a production meets the criteria set out in the relevant coproduction treaty. It provides CAVCO with both a Preliminary Recommendation and a Final Recommendation as to whether a production meets treaty requirements.

CAVCO makes a recommendation to the Minister of Canadian Heritage as to whether or not the coproduction should be certified under the CPTC program.

See Chapter 5 for more information on treaty coproductions.

Applicants are responsible for submitting complete CPTC applications to CAVCO.

Production companies must file complete applications through the CAVCO Online application system, accessible through CAVCO’s website.

Supporting documentation must be included as part of a complete Part A or Part B application to CAVCO. A list of this documentation can be found in the “How to apply” section of the CPTC page on CAVCO’s website. Note that CAVCO does not accept redacted documents.

Incomplete applications will not proceed for analysis with a tax credit officer unless all required information and documents are received.

If information or documentation required to determine the eligibility of a production is not provided to CAVCO upon request, CAVCO could recommend the file for denial or revocation at any time. For more information on the process for denials or revocations, see section 1.11.

CAVCO reserves the right to request any additional information, affidavits or sworn statements necessary to ensure that a CPTC certificate should be issued for a production.

CAVCO may also ask the production company to provide any necessary records or financial documents for auditing purposes. The production company must ensure that adequate space and time are provided, and that all relevant documents are made available, for an audit.

While a copy of a production (three representative episodes for a series) is always required at the Part B application stage, CAVCO may also request a copy at the Part A stage (a rough cut is acceptable) where necessary. This may occur, for example, where there is a potential concern related to the production meeting genre or lead performer eligibility requirements.

Where a copy of the production is requested at the Part A stage, note that a final copy of the production is still required with the Part B application for the production.

CAVCO also reserves the right to request more episodes of a series at any stage of analysis. This may occur, for example, where there is a concern with the eligibility of one or more of the episodes submitted originally. In rare cases, CAVCO may ask to see all episodes in a series.

A fee is required for each application to CAVCO.

The fee amount for an application may be adjusted by CAVCO prior to certification, where a change to the production budget or production financing affects the eligible production cost. In the event this results in an additional fee being owed by the applicant, the outstanding amount must be paid before the certificate is issued. Overpayments will be refunded after Part B certification for the production.

More information on application fees is available on CAVCO’s website.

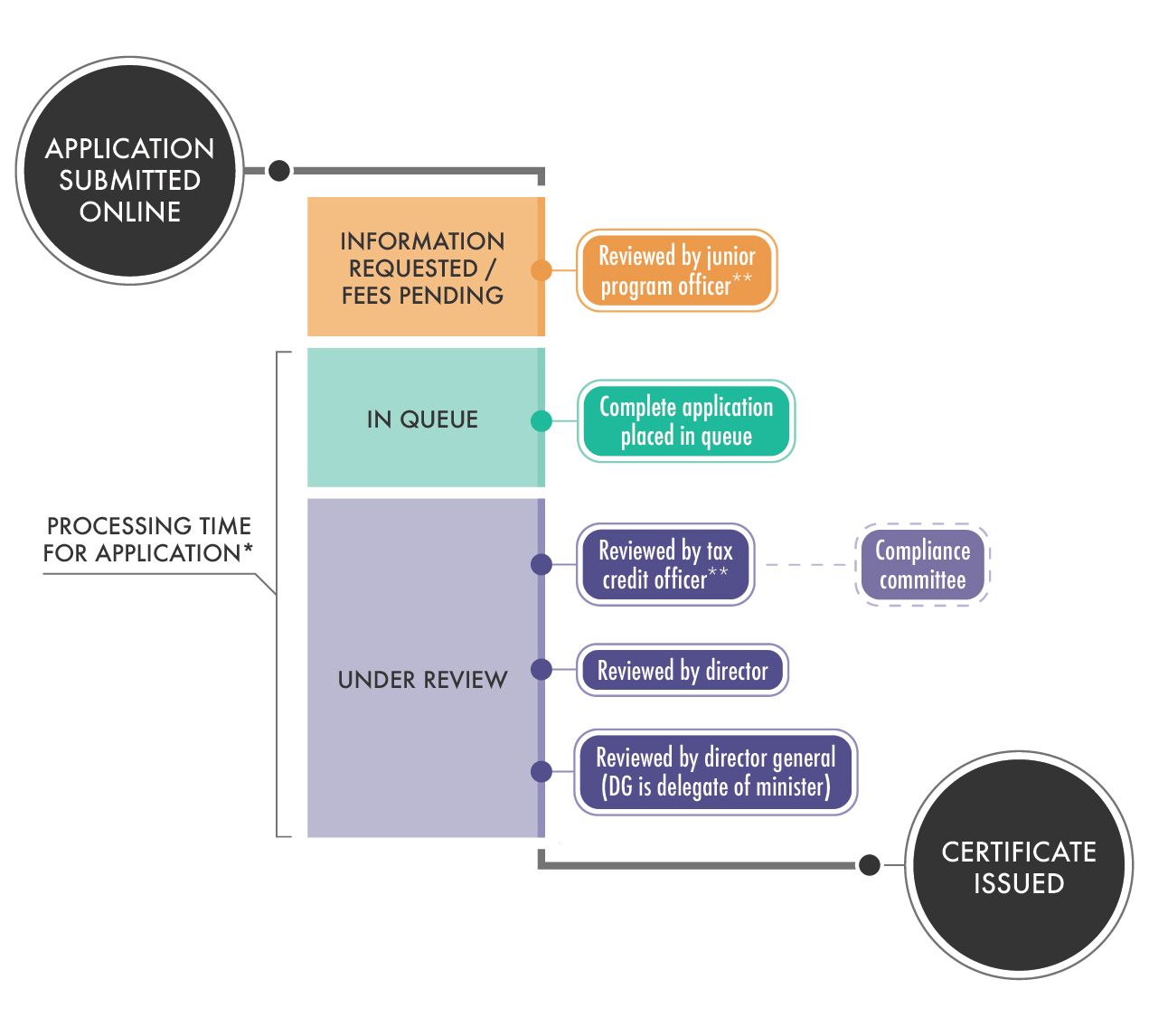

When an application is received by CAVCO, it is reviewed for completeness. Once an application is complete, it is placed in a queue to be assigned to a tax credit officer.

When the application is assigned to a tax credit officer, they will review it and contact the production company if additional information or clarification is needed.

Once the tax credit officer’s review is complete, the file is advanced for further approvals, ending with a final recommendation being made to the Director General of Cultural Industries to either certify the production, or deny or revoke the certification of the production, on behalf of the Minister of Canadian Heritage. The applicant is notified as soon as possible of the decision.

Notifications from CAVCO are sent to the applicant’s Message Centre in the CAVCO Online system. It is therefore important for the applicant to check their messages on a regular basis. Applicants should also ensure that all contact information for their applications (including e-mail address, phone number and mailing address) is kept up to date.

See Figure 1 below for more details on CAVCO’s application review process.

Figure 1: Stages for review of applications at CAVCO

Figure 1: Stages for review of applications at CAVCO - Notes

The three boxes on the left side of the diagram represent the different file status messages that an applicant sees in the CAVCO Online system.

* For more information on CAVCO’s service standards and processing times, see the CAVCO Performance Results webpage.

** Officers may request missing information or additional clarification for a file. The application does not progress to the next stage of analysis until all required information is received.

While there is no deadline for applying to CAVCO for a Part A certificate for a production, there are deadlines for applying for a Part B certificate, and for this certificate being issued by CAVCO to the applicant.

The initial Part B application deadline is 24 months from the end of the corporation’s taxation year in which the production’s principal photography began (the “24-month deadline”). Footnote 5

This deadline can be extended to 42 months from the first taxation year end date (the “42-month deadline”), as long as the applicant files valid T2029 waivers with the CRA for both the first and second taxation years ending after principal photography began. CAVCO verifies directly with the CRA that valid waivers, when required, have been filed.

See CAVCO’s website for more information on how to fill out and file these waivers, and to view a sample waiver.

For clarity purposes:

The normal reassessment period for a taxation year is three years from the date of the mailing of the notice of assessment for Canadian-controlled private corporations, and four years from this date for public corporations.

A failure to meet the final 42-month deadline, or to file valid waivers when required, will result in a previously issued Part A certificate being revoked, or a Part A/B application being denied.

When two or more Canadian production companies enter into a domestic coproduction arrangement (see section 2.03), the deadlines for applying to the CPTC are determined using the taxation year end of the primary applicant. If the primary applicant is submitting a Part B application after the 24-month deadline, the coproducing partner will also have to file waivers with the CRA.

A Part B certificate must be issued within 6 months of a production’s application deadline. The 48-month deadline is therefore the final date by which CAVCO must issue a Part B certificate for a production.

An applicant must submit a complete application and respond to all requests for information or clarification from CAVCO in a timely manner, so that CAVCO’s analysis can be completed, and a certificate issued, by this final deadline.

If no Part B certificate is issued by the 48-month deadline, a previously issued Part A certificate will be revoked, or a Part A/B application will be denied.

Corporate Taxation Year End December 31 Start of Principal Photography February 3, 2015 End of taxation year in which principal photography began December 31, 2015 End of following taxation year December 31, 2016 24-month Part B application deadline December 31, 2017 42-month Part B application deadline June 30, 2019 48-month Part B certification deadline December 31, 2019

In this example, if the Part B application is being submitted after the 24-month deadline:

The applicant is responsible for ensuring that all Part B deadlines are met. As a courtesy to applicants, CAVCO does issue reminder notices of Part B application deadlines at the 22-month, 24-month, 40-month, and 41-month marks based on dates submitted in the Part A application.

When the taxation year end provided by the applicant with a Part A application is incorrect, or is later changed Footnote 6 without CAVCO being informed, CAVCO reminder notices may also be incorrect.

Note that once the first taxation year end has been confirmed through a company’s first filing of a T2 return for that year, Part B deadlines will continue to be calculated by reference to this date, even if the company later changes its taxation year.

Due to the effect of COVID-19 on the Canadian audiovisual sector, the Department of Finance Canada has introduced temporary extensions to various timelines applicable to the CPTC.

Applicants who incurred labour expenses for a production during their taxation year ending in 2020 or 2021 may be eligible for an additional extension to their Part B application and certification deadlines for the production.

If CAVCO determines that a production may not be eligible under the CPTC program, the file is submitted to CAVCO’s Compliance Committee for review of the issue(s) of ineligibility.

Based on this review, additional information or clarification may be requested from the applicant, or the file may be recommended for denial (for a Part A or Part A/B application) or revocation (for a Part B application). For more information on the process for denials or revocations, see section 1.11.

If an application is for a Part A certificate, or for both Part A and Part B certificates at the same time, and the production does not meet the requirements for CPTC certification, the production will be denied certification.

Where a Part A certificate has already been issued for a production, it may be revoked by the Minister of Canadian Heritage where:

Where a review of an application reveals an issue of ineligibility, CAVCO sends the applicant an advance notice detailing the reasons why the production appears to be ineligible. The applicant is provided the opportunity to submit additional information that may impact the final evaluation of the application.

If, after considering the additional information, CAVCO makes a final recommendation that the production not be certified, or if the applicant fails to provide a response within the allotted time frame, the applicant is sent a final notification of denial or revocation issued by the Director General, Cultural Industries, on behalf of the Minister.

A certificate that is revoked is deemed never to have been issued. CAVCO provides a copy of the final notice to the CRA for all denials and revocations.

Applicants may apply to the Federal Court for judicial review of a final decision within 30 days of being notified by CAVCO of the decision. To apply for judicial review, an applicant must send a completed Form 301, Notice of Application (Federal Court website) ( PDF format), with the appropriate filing fee, to the registrar of the Federal Court. For more information on how to file an application for judicial review, or other general enquiries, visit the Courts Administration Services website.

Each year, CAVCO performs a more in-depth review of a select number of applications. CAVCO reserves the right to request any additional information necessary for a complete audit of the application.

A production company may ask CAVCO to provide a preliminary opinion on the eligibility of a production for CPTC certification with respect to a specific issue. This opinion is based strictly on the information made available at the time to CAVCO, and is not binding on whether or not the production will ultimately be eligible, including with respect to the specific issue identified in the pre-assessment request. Full Part A and B applications for a production must ultimately be received for CAVCO to provide a final recommendation to the Minister of Canadian Heritage regarding the production’s eligibility.

A request for a pre-assessment may be submitted to CAVCO only if a CPTC application for the production has not yet been submitted, and if the production has been substantially developed.

Requests for pre-assessments can be sent to CAVCO’s Compliance Committee at bcpacc-cavcoc@pch.gc.ca.

All pre-assessment requests must include:

If no specific eligibility concerns are identified and explained, CAVCO will not be able to proceed with a pre-assessment.

If the concern relates to whether a production falls under an ineligible genre category, the request must include, in addition to the specific genre(s) of concern:

CAVCO’s pre-assessment letter must be attached to any future CPTC application made to CAVCO for the production.

All information provided by an applicant under the CPTC program is subject to the taxpayer confidentiality provisions in section 241 of the Income Tax Act . This section restricts how government officials can use or communicate information obtained for the purpose of administering the Act. The full text of section 241 of the Income Tax Act can be found on the Department of Justice website.

Subsection 241(3.3) of the Act allows the communication of limited information regarding productions that have been Part A certified under the CPTC program. Accordingly, CAVCO publishes a list of titles and associated production companies for all Part A certified productions. A link to the list is available on CAVCO’s website.

Under section 241 of the Act, CAVCO can share information with:

The Canadian production company, as well as the individual(s) occupying the producer position, must be clearly identified and given prominence on screen in the main titles, and in all billing blocks.

The Canadian copyright notice must also appear in the tail-end screen credits.

The “Canada” wordmark logo, accompanied by the wording “Canadian Film or Video Production Tax Credit,” must appear on all domestic and international versions of each certified production, and in all related advertising, publicity and promotional materials. More information can be found on CAVCO’s website.

The CRTC has a Canadian content certification program that is similar in many respects to the CPTC certification process. However, no tax credit is provided through the CRTC.

For the purpose of CRTC program logs, broadcasters can submit a CPTC certificate number for a production, in lieu of the certification (“C”) number issued through the CRTC’s Canadian Program Certification section.

For more information, visit the CRTC’s website.

The production company producing a film or video production and applying for CPTC certification must demonstrate that it is a “prescribed taxable Canadian corporation,” as defined in the Regulations.

This means the corporation must be a taxable Canadian corporation Footnote 7 that is:

For the purpose of sections 26 to 28 of the Investment Canada Act , “Canadian” means:

For a production company to meet the Canadian ownership and control requirements of the CPTC program, there must be control in law (“ de jure ” control) of the company by Canadians, with respect to shareholders’ voting rights. It must also be clear that this extends to control in fact (“ de facto ” control), having regard for the nature of shareholders’, officers’ or directors’ involvement with, or influence within, the company. In other words, de facto control may exist when another corporation, person or group of persons has any direct or indirect influence that, if exercised, would result in control in fact of the corporation.

The assessment of a company’s eligibility is based primarily on information provided by the applicant in the “Shareholders” section of an application.

CAVCO may in some cases request additional information to confirm the control of a corporation based on the rights, privileges and decision-making authority of shareholders (e.g., through articles of incorporation, shareholder agreements, trust agreements, legal opinions, organization charts or similar documentation).

CAVCO may request additional supporting documents for a publicly traded company, such as the company’s articles of incorporation, its notice of registered office, or a certified list of shareholders. Additional documents may also be required if a shareholder is an entity such as a sole proprietorship, a partnership or a trust.

Any corporate shareholder (or a shareholder such as a partnership or a trust) owning a majority of voting shares in the production company must also be shown to be Canadian-controlled.

Where there are several minority shareholders that are corporations or other business entities, it must be shown that a majority of shares are owned by Canadian-controlled entities.

A company applying for the tax credit under the CPTC program must be a “qualified corporation,” as defined in the Act.

Under this definition, a corporation must be one that is, throughout a given taxation year, a prescribed taxable Canadian corporation (see section 2.01) whose activities consist primarily of carrying on a Canadian film or video production business, through a permanent establishment in Canada.

Where the business of a corporation consists primarily of other activities such as the rental of equipment or studios, the distribution of audiovisual productions, or the production of films or videos that are not Canadian film or video productions, the corporation is not considered a qualified corporation.

If a corporation engages in more than one business, the assessment of its primary activity is based on evaluating factors such as the revenues generated by each business, the capital employed in each business, and the time spent by employees, agents or officers on each business.

The CRA determines whether a production company is a qualified corporation. If a production company is unsure whether or not it is a qualified corporation for tax credit purposes, it may contact its regional Film Services Unit of the CRA prior to submitting an application to CAVCO.

A domestic coproduction is a production for which more than one Canadian production company incurs expenses.

Only one application for certification is submitted to CAVCO through the company designated by the coproducers as the primary applicant for the application. However, information on all coproducing companies must be included with the application. Each production company must be a prescribed taxable Canadian corporation and a qualified corporation.

For domestic coproductions, CAVCO issues only one CPTC certificate. Each production company may then claim their own portion of the tax credit with the CRA.

Note that where two or more partnering Canadian production companies incorporate a subsidiary company to be the sole production company for a production, the production should not be identified as a domestic coproduction in an application to CAVCO.

Unless a production is a treaty coproduction, only the Canadian production company or a “prescribed person” can be a copyright owner of the production for all commercial exploitation purposes, for the 25-year period beginning when the production is completed and commercially exploitable.

No other person or entity can place any restriction on the ability of the production company or prescribed person to exercise full copyright ownership rights in the production during this period. This is verified by CAVCO through its review of documents such as exploitation, financing and chain-of-title agreements.

Under the Regulations, a “copyright owner” for the purpose of the CPTC can be:

For greater certainty, the granting of an exclusive licence within the meaning of the Copyright Act (for example, to a broadcaster or a distributor) is not an assignment of copyright.

In the Regulations, a “prescribed person” is defined as:

Note that if an entity other than the Canadian production company is a copyright owner of a production, this may have an impact on how a Capital Cost Allowance for the production is claimed. Production companies may consult with their regional CRA Film Services Unit office for further information on this issue.

For other entities acting as prescribed persons, CAVCO will ask the applicant to provide documentation where necessary.

A non-prescribed person may make an investment in a production or participate in profits generated from a production, but cannot be a copyright owner of the production, or have any control over the initial licensing of commercial exploitation rights for the production.

Note that in cases where a non-prescribed person invests in a production without being a copyright owner, CAVCO examines relevant agreements to ensure that their involvement does not raise any concerns related to:

There is not a list of production genres that are eligible under the CPTC program. Instead, the Income Tax Regulations outline ten genres (listed below) that are not eligible for the program. Additional clarifications on how CAVCO assesses ineligible genres, including relevant definitions, can be found in section 4.03.

At the Part A application stage, CAVCO reviews the synopsis for the production. If the synopsis does not provide sufficient information about a production’s genre, CAVCO may also request other script material (for example, a treatment, a screenplay, or an episodic breakdown) or, in some cases, a preliminary copy of the production.

At the Part B application stage, CAVCO reviews a copy of the production.

Note that when CAVCO is reviewing an application for a new season of a series that has been certified in previous seasons, the genre of the new season is still assessed.

See section 1.13 for more information on requesting a pre-assessment related to genre eligibility.

A production that:

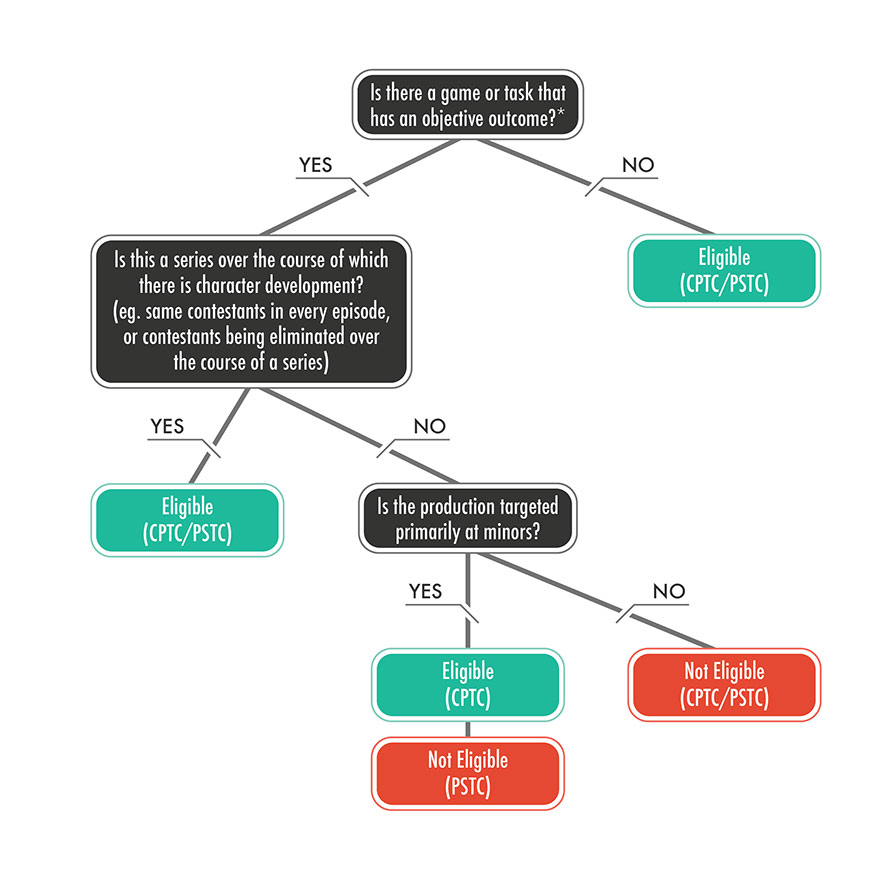

A production where individuals or teams participate in a game, quiz, or contest that has an objective outcome (e.g., right/wrong, complete/incomplete, fastest time, highest score) to determine a winner, whether or not a prize is awarded.

A production that combines tasks that are measured objectively with tasks that are measured subjectively is included in this genre.

A production that includes competitive elements but features character development over the course of a series (e.g., by starting with a group of participants who are competing against each other and who are eliminated as the series progresses) is not included in this genre.

See Figure 2 below for more information on how CAVCO evaluates whether productions fall under this genre.

Figure 2: A production in respect of a game, questionnaire or contest (other than a production directed primarily at minors)

Figure 2: A production in respect of a game, questionnaire or contest (other than a production directed primarily at minors) – Notes:

A production that consists of:

A production that consists of:

A production that includes a segment of any length aimed at soliciting funds or other contributions from viewers.

Hope for Haiti Now telethon, Jerry Lewis MDA Labor Day telethon, Le téléthon de l’Association française contre les myopathies

A production that consists of:

A production that contains explicit depictions or descriptions of a sexual nature, without regard to artistic merit.

Element 2: A production… that includes a call to action soliciting the viewer to purchase a good or service (e.g., directing the viewer to a store or website other than the production’s website).

Element 3: A production… that promotes broadcast schedules or programming.

Element 4: A production where more than 15% of the running time consists of:

Affirmative answers to these questions are expected for CAVCO to consider the presentation of a product or service to be a review. If CAVCO determines that a production is a review show, or that a segment within a production features the review of a product or service, the positive references to these products or services, as well as any shots of logos appearing during reviews, will not be counted towards the 15% total in element 4 of the definition.

If, on the other hand, CAVCO determines that the presentation is not a review, it will count towards the 15% evaluation in element 4 of the definition.

A production primarily made to meet the specific industrial, corporate or institutional needs of a business, organization, government entity, or industrial sector.

Productions such as, but not limited to, recruitment videos, corporate training videos, public service announcements and promotional videos are included in this genre.

A production, other than a documentary, all or substantially all of which consists of pre-existing footage.

An audiovisual coproduction is a production created by pooling the creative, technical and financial resources of coproducers.

Coproductions produced according to the terms of a coproduction treaty between Canada and another country are granted national status in each country, and are eligible for the CPTC where they meet all other applicable requirements under the Regulations.

The recognition of a project as a treaty coproduction must be obtained from the designated authority in each coproducing country.

Telefilm Canada: As the administrative authority for coproduction treaties involving Canada, Telefilm reviews coproduction applications to determine whether they meet the provisions of the applicable coproduction treaty. Telefilm provides CAVCO with a preliminary and a final recommendation on whether or not the production meets the terms of the relevant treaty.

The full text of all current coproduction treaties, as well as Telefilm’s policies, guidelines and online application portal, are available on Telefilm’s website.

CAVCO: CAVCO will assess the production’s compliance with the treaty, taking into account the recommendation made by Telefilm. CAVCO recommends to the Minister of Canadian Heritage to certify a coproduction as a “Canadian film or video production” where it meets the requirements of the treaty and all other applicable CPTC requirements under the Act and Regulations.

The Minister is responsible for rendering the final decision as to whether a production is a treaty coproduction that can be certified under the CPTC program.

For clarity: a production company must submit separate applications to both Telefilm and CAVCO to have a production certified as a treaty coproduction pursuant to the Act and Regulations.

The following requirements in the Act and Regulations do not apply to treaty coproductions:

All other CPTC requirements still apply to treaty co-productions.

A CPTC certificate may be used by Canadian funding programs, broadcasters or regulatory authorities as recognition that a production has been granted treaty coproduction status by the Minister of Canadian Heritage.

However, there may be cases where a production is not eligible for the CPTC, despite conforming to the requirements of a coproduction treaty. This may occur, for example, where a CPTC application or certification deadline is not met, or where the production is an interactive digital media production that is not eligible for the CPTC.

Upon request by the production company, CAVCO may in these cases issue a “coproduction attestation” letter, which provides a “CP” number for the production. This letter from the Director General, Cultural Industries on behalf of the Minister, confirming that the project has achieved treaty coproduction status outside of the framework of the Act, may then be filed with funders, broadcasters or other authorities as necessary.

Contact CAVCO for details on how to apply for a coproduction attestation letter.

Co-ventures are international productions that are not produced in accordance with an audiovisual coproduction treaty. Co-ventures do not qualify for the CPTC.

To be eligible for CPTC certification, a production must meet requirements related to the staffing of Canadian key creative and producer-related personnel on the production. See sections 6.02 to 6.12 for more information on these requirements.

An applicant must provide proof that individuals for whom key creative points are being requested, as well as individuals occupying producer-related positions, are Canadian. This is demonstrated through the applicant providing CAVCO Personnel Numbers (also known as CAVCO IDs) for these individuals, within their application. Footnote 13

The term "Canadian," in this context, refers to a person who is a Canadian citizen as defined in the Citizenship Act , or a permanent resident as defined in the Immigration and Refugee Protection Act . The person must be Canadian during the entire time they perform any duties in relation to the production.

Note that this use of the term “Canadian” is different from the definition of “Canadian” found in the Investment Canada Act , used for determining whether a production company is Canadian-controlled (see section 2.01).

A permanent resident of Canada is a person who has acquired permanent resident status pursuant to the Immigration and Refugee Protection Act . To maintain this status, the person must meet certain minimum residency requirements during each five-year period.

Permanent residents may apply for Canadian citizenship once they have been ordinarily resident in Canada for at least three of the previous five years, and have met certain other requirements.

For more information on permanent residency status or obtaining Canadian citizenship, consult the Immigration, Refugees and Citizenship Canada website.

To obtain a CAVCO Personnel Number, an individual occupying a key creative or producer-related position must submit an application with a document demonstrating Canadian citizenship or permanent residency. More information on the application process for CAVCO Personnel Numbers is available on CAVCO’s website.

Each individual confirmed as a Canadian citizen or permanent resident is assigned a unique CAVCO Personnel Number. Production companies applying to CAVCO for a production must obtain these numbers directly from individuals occupying key creative or producer-related roles. CAVCO does not provide these numbers to production companies.

Canadian citizens need to apply only once for a CAVCO Personnel Number.

Permanent residents need to resubmit proof of permanent residency status when their permanent resident card expires. CAVCO Personnel Numbers issued to permanent residents have a zero as the first digit in their numerical portion (e.g., ABCD0123).

CPTC applicants must ensure that any Canadian filling a producer-related or key creative role in their production has obtained a CAVCO Personnel Number. Production companies are encouraged to obtain the numbers at the time of hiring any individuals occupying these positions.

If the CAVCO Personnel Number provided to a production company identifies an individual as a permanent resident, the production company should ensure that the individual can demonstrate, with a valid permanent resident card, that they have permanent resident status at the time they are providing services to the production.

Applicants are strongly encouraged to submit CAVCO Personnel Numbers at the time of their Part A application. The numbers are mandatory for all Part B or Part A/B applications. Note that the failure of an applicant to submit one or more CAVCO Personnel Numbers with a Part B or Part A/B application will result in fewer points being allotted to the production and, in some cases, in a production being ineligible.

The following documents are accepted as proof of Canadian citizenship or permanent residency:

To be a Canadian film or video production, a live action production other than a treaty coproduction (see Chapter 5) or a documentary (see section 6.04) must be allotted a total of at least six points based on the table below. Points are allotted only if all individuals occupying the position are Canadian.

In addition, the following requirements must be met:

There are 10 possible key creative points available for a production. If some points are not applicable, the total number of available points is reduced accordingly. For example, if a production has only one lead performer, and this person and all others occupying key creative positions are Canadian, the production will receive 9 out of 9 points.

(Production must obtain at least two of these four points)

(Production must obtain at least one of these two points)

To be a Canadian film or video production, an animation production must (other than if it is a treaty coproduction – see Chapter 5) be allotted a total of at least six points based on the table below. A point will be allotted only if all individuals occupying the position are Canadian or, in the case of location-based points, where the work is performed solely in Canada.

In addition, the following requirements must be met:

(Production must obtain at least one of these two points)

Principal screenwriter and

For the purpose of the CPTC program, a documentary is defined as an original work of non-fiction, primarily designed to inform but that may also educate and entertain, providing an in-depth critical analysis of a specific subject or point of view.

If a documentary production does not have lead performers or other positions such as art director or music composer, it can still meet the key creative point requirements even if it has not been allotted the six points, or has not obtained one of the two points allotted for lead performers. However, all the filled key creative positions must be occupied by Canadians. For example, a documentary production can receive 5 out of 5 points and be eligible.

To obtain the two points for the position of screenwriter, a live-action production must meet one of the following conditions:

At least one point must be allotted to either the lead performer with the highest remuneration or the lead performer with the second highest remuneration Footnote 17 , for a production to qualify for CPTC certification.

It is rare for a production (other than a documentary) to have no lead performer. If CAVCO reviews a production and concludes that there are no lead performers, the requirement to have a lead performer point will not apply. The production must still meet the requirement of having at least six points or, in the case of documentaries (see section 6.07.09), having all key creative positions occupied by Canadians.

Allotting points to lead performers is a two-step process.

The first step is to determine who the lead performers are in a production. There may not be any lead performers, or there could be several. There is no ranking of performers at this step and their citizenship is not taken into account. There is only a determination of which individuals, if any, are giving lead performances.

As indicated in the Regulations:

A lead performer in respect of a production is an actor or actress who has a leading role in the production having regard to remuneration, billing and time on screen

It is important to note that in practice these three elements do not always run in parallel. For example, the performer with the highest remuneration could have the third longest screen time and receive the second highest billing.

While non-fiction productions may not have an "actor or actress," this does not mean there are no performances being given or no leading roles. For example, hosts, narrators, dancers, singers, specialty act performers, featured experts, judges on a panel, and subjects in lifestyle/human interest productions will all be considered performers. The determination that needs to be made in these cases is whether they have leading roles, and are therefore lead performers. See section 6.07.06 for more information on lead performers in non-fiction productions.

A lead performer should be an individual (whether performing as a character or not) who carries the story in a fiction or non-fiction production. A performer who has only a minor or peripheral role will not be considered a lead performer by CAVCO. This will be the case even if the character or individual in question may be considered crucial to a pivotal plot point or is otherwise integral to the production.

While this approach means that a Canadian will not be allotted a key creative point for a minor role, it also means that a non-Canadian will not be considered a lead performer when they are in a minor role.

The elements of time on screen, remuneration and billing are not necessarily weighed equally in making a determination of lead performance. See below for more information on the factors that CAVCO considers with respect to each element.

In considering these three elements, CAVCO examines the claims made by the applicant with respect to which performers are leads, while also considering performers not claimed as lead performers, to determine if they should in fact be considered leads.

Time on screen - Generally speaking, the "time on screen" element is a very important factor in the determination of whether a performance is a lead performance. While there is no set minimum time on screen for a performer to be considered a lead performer, it should be obvious when viewing the production who the lead performers are, and they must have more than a brief, incidental presence in the production. Remuneration and billing are expected to be roughly in line with what is seen on screen.

CAVCO considers the total time of the performance (whether on-screen or off-screen) in determining whether the role should be considered a lead performance or a minor role. Time spent by a performer in the background of a scene will not be counted towards the total time.

Remuneration - CAVCO takes into account direct and indirect financial compensation, as well as additional benefits, residuals, contingent compensation, travel or living expenses, and any similar expense incurred in relation to an individual. The remuneration for a performance must not be allocated to other duties to make it lower (e.g., by entering into a second contract with the person for consulting or other services).

While there is no minimum threshold for remuneration for a lead performance, and no requirement for lead performers to be paid equally or have similar remuneration, the relative remuneration of performers will be used as an indicator in determining whether or not an individual is a lead performer.

CAVCO recognizes that there are many factors that come into play when production companies determine remuneration for a performer, and remuneration (either relative or absolute) will never be used in isolation to determine whether a given performer is a lead performer. However, it can be looked at in combination with the other two elements to either support or refute the notion that a given performer is a lead performer.

Billing - The primary consideration for this element is how the performers are billed in the screen credits. For non-fiction productions in particular, CAVCO will also consider how the claimed lead performers are featured in publicity for the production. For example, if the claimed first lead is promoted heavily in connection with the production and the claimed second lead is only promoted minimally or not at all, this will be used as an indicator that the claimed second lead may not truly be a lead performer. The same principle applies where a claimed first lead is not promoted at all, while other individuals are heavily promoted as being the stars or featured performers in the production.

While it is understood that production companies are not always in control of all publicity surrounding a production, experience has shown that a review of the publicity for a non-fiction production often supports preliminary conclusions based on an evaluation of the time on screen element. Information found in publicity will never be used on its own to conclude that an individual is, or is not, a lead performer.

Once the lead performers in a production have been established, their respective remunerations are used to rank them in order of highest to lowest paid. One point is then allotted if a Canadian is receiving the highest remuneration, and one point is allotted if a Canadian is receiving the second highest remuneration. At this step, the time on screen and billing are no longer considered; only remuneration is relevant.

In cases where a Canadian and a non-Canadian lead performer are remunerated equally, the non-Canadian lead performer will be ranked above the Canadian.

For example, if the total remuneration for Canadian lead performer A is $50,000, and the remuneration for Canadian lead performer B and non-Canadian lead performer C is $40,000 each, a point will go to Canadian A as the highest paid, but no point will be allotted for the second highest paid, since the position will be deemed to be occupied by the non-Canadian. Canadian lead performer B will be ranked third.

As another example, if there are three lead performers all being remunerated equally at $50,000 each but two of them are non-Canadian and one is Canadian, the two non-Canadians will be ranked first and second in remuneration, with the Canadian third. Therefore, no lead performer points will be allotted and the production will be ineligible.

For animation productions, there is only one point available for the lead voice. It is allotted if the lead voice that was paid either the highest or second highest remuneration is Canadian. The point must be given for the production to qualify.

In the rare situation where there is no lead voice in an animated production, there is no requirement to have the lead voice point. The production must still have at least six points.

As with live action productions, allotting a point to a lead voice (who can be performing one or multiple characters) is a two-step process.

The first step of determining who the lead voices are is the same as the determination of lead performances for live action productions, except that “billing” is not one of the considerations.

As indicated in the Regulations:

A lead voice in respect of an animation production is the voice of the individual who has a leading role in the production having regard to the length of time that the individual's voice is heard in the production and the individual's remuneration.

The allotment of the point is based on the remuneration of the lead voice(s), as with Step 2 for live action productions.

As noted above, there is only one point available for the first or second highest remunerated lead voice; even if both the first and second highest remunerated lead voices are Canadian, only one point can be allotted. As with the approach for live action productions, if a Canadian and a non-Canadian lead voice are remunerated equally, the non-Canadian will be ranked ahead of the Canadian.

A guest appearance is a substantial role in one episode or a few episodes of a series, performed by someone who is not a part of the regular cast. A guest performer will be evaluated using the same criteria outlined above for other performers, in determining whether the performance in question is a lead performance. If it is a lead performance, the remuneration of that performer will be compared to the remuneration of the other lead performers to determine if they are the first or second lead for the purpose of allotting key creative points.

A cameo is a brief appearance of a known person in a production, generally in a single scene. By definition this would be a minor role, and the individual in question will not be considered a lead performer.

In a non-fiction series, any distinct, recurring individual who carries the story, or upon whom the story is based, will generally be considered a lead performer. This is the case even if the production is unscripted or if the individual is being followed while going about their regular life or doing their job, unless they are the subject of a biographical documentary - see section 6.07.09.

In a non-fiction series where different individuals are receiving help from a specialist in each episode (for example, in a home design show), they will not be considered lead performers.

In a competitive lifestyle/human interest series that (a) eliminates participants over the course of the series, or (b) features different participants in each episode, these participants will not be considered lead performers.

The lead performers for live theatre, musicals, opera, dance, and other similar productions are determined in the same fashion as for other live action productions.

In music performances featuring a single solo artist, that artist will be a lead performer. For a performance by a band, the band leader (as determined by contract) will be the lead performer. For performances by an orchestra (with no featured solo artist) the lead is generally the concert master.

If a production is a recording of a live performance that is taking place regardless of the fact that it is being recorded, the remuneration that can be claimed for the production, and considered for the purpose of allotting lead performer points, is the amount that the performer is receiving for being recorded, not for the actual live performance. For example, an actor may be paid a fee for their performance in a play over the course of a two-week run. If one of those performances is recorded, the actor will be paid a supplementary fee for the recording. It is only this additional fee that can be counted as remuneration in the production budget and for the purpose of allotting lead performer points.

Where two or more versions of a production are produced concurrently (up to the end of the post-production stage), the lead performers for all versions must be Canadian to receive the required lead performer point(s). For example, the narrators of a documentary with both French and English versions must both be Canadian.

As noted previously, a documentary production obtaining fewer than six points due to certain key creative positions being unoccupied is still eligible for certification, if all occupied key creative positions are held by Canadians.

This applies only to documentary productions that have fewer than six points, and has no bearing on the requirement for a Canadian lead performer. Documentaries can, and often do, have lead performers. For example, a host, narrator, or other individual who is seen or heard throughout the production and who advances the storyline is usually considered a lead performer. This assessment is carried out in the usual manner for determining lead performers in live-action productions. If there is only one lead performer in a documentary, that person must be Canadian. If there are two lead performers, one of them must be Canadian.

The subject of a biographical documentary will not be considered a performer.

Voice-over by a subject or an interviewee in a documentary (i.e., content from an interview that is heard over other images, rather than in sync) will not be considered narration or a performance. However, if an interviewee is also providing scripted narration for the production, the total time on screen (for on-screen interview, voice-over, and narration) will be considered, along with billing and remuneration, in evaluating whether the individual is a lead performer.

As with all genres of production, if there is no lead performer, there is no requirement to have a lead performer point to be eligible for certification.

The point for the position of music composer is allotted only if all original music created for a production is composed by a Canadian.

Note that where original music created by a Canadian for the first season of a series continues to be used for subsequent seasons of the series (with no new additional original music by a non-Canadian), the production company may continue to claim the music composer point for later seasons.

A producer is the individual who:

All positions related to the producer function must be held by Canadians unless the production is a treaty coproduction, or an exemption for a foreign producer-related credit is granted by CAVCO. Note that exemptions are not granted for the functions of producer, coproducer or line producer, as these positions must be held by Canadians.

Sections 6.09-6.13 do not apply to treaty coproductions. For information on producer-related personnel requirements for treaty coproductions, refer to the relevant coproduction treaty and Telefilm Canada’s coproduction guidelines. See Chapter 5 for more information on treaty coproductions.

The following five indicators provide further guidance on how control over a production is assessed, based on the definition of “producer.” Footnote 19

Where documentation (e.g., chain-of-title, financing, exploitation or key creative / producer personnel agreements) suggests that a production does not adhere to one of these indicators, the producer will have the onus of establishing, to the satisfaction of CAVCO, that the situation does not interfere with the producer’s responsibilities and ultimate creative and financial control over the production.

the producer will have the onus of establishing, to the satisfaction of CAVCO, that the situation does not interfere with the producer's responsibilities and control. Provision will be made for industry-standard completion guarantees.

The applicant must ensure that the production company has the full, unencumbered right to develop and produce the production, most often demonstrated through chain-of-title documentation.

Examples of chain-of-title documents include, but are not limited to,

Applicants may be required to provide, at the request of CAVCO, all such documents covering the time period from the creation of the concept to when the production company acquires all the rights necessary to produce the production.

An exemption for a credit for a non-Canadian individual occupying a producer-related position is granted only where:

A non-Canadian granted a producer-related screen credit, other than a lead performer or an individual working in the story department (including a showrunner), is limited to being on set for a maximum of 25% of principal photography.

Any non-Canadian individual receiving a producer-related credit must file a CAVCO affidavit (Form 01F12, or Form 01F13 for a showrunner) outlining the duties performed, and declaring that those duties have been or will be carried out only under the direction and control of, and with the full knowledge of, the Canadian producer. Note that Form 01F12 is not required when the individual is also a lead performer in the production.

These forms can be found on CAVCO’s website and should be submitted at the Part A application stage.

See also section 6.13 for information on non-Canadian showrunners.

Permitted exemptions for non-Canadian producer-related screen credits are generally limited to those in Group A or Group B, as set out below. Note that if a credit consists of one of these credits with the addition of the prefix “co-“, CAVCO will view this as being equivalent. For example, “Co-Executive Producer” will be considered the same as “Executive Producer.”

Group A:

Executive Producer

Senior Executive in Charge of Production

Executive in Charge of Production

Supervising Producer

Associate Producer

Group B:

Supervising Executive

Production Supervisor

Production Executive

Production Associate

Executive Consultant

Production Consultant

Creative Consultant

While credits for non-Canadians may be chosen from either group, they cannot exceed the number of credits given to Canadians from the same group, or in the case of Group B credits, from the same group or Group A.

For example, if a non-Canadian is given one Group A credit, at least one Canadian must be given a Group A credit. If two non-Canadians are given a Group B credit, at least two Canadians must be given a credit from either Group A or Group B.

While production companies most commonly use the credits listed above, a non-Canadian can receive a different credit similar to those in the Group A or B lists, as long as the individual’s role is consistent with the requirements set out in section 6.12.01, and the credit being given is matched by an identical credit, or a Group A credit, given to a Canadian.

A production company may be contractually required to give an individual a producer-related credit strictly in relation to their role as a representative of a broadcaster or distributor, even though the individual may have no direct involvement in the specific production. These credits include the name of the broadcaster or distributor (e.g. Executive in Charge of Production, BBC), and appear in the tail credits.

In these cases only, CAVCO does not require applicants to list these individuals in their application, or to provide supporting documentation such as CAVCO Personnel Numbers (for Canadians) or affidavits (for non-Canadians). These individuals will also not be taken into account in verifying whether a production meets the matching Group A and Group B credit requirements. CAVCO may ask for additional information where necessary to confirm the nature of the individual’s involvement in a production.

Note that representatives of broadcasters or distributors cannot be given the credit “producer” – for example, “Producer, BBC”.

Any non-Canadian working as a showrunner for a production, regardless of the actual credit they are receiving, must file a CAVCO showrunner affidavit (Form 01F13) declaring that any work performed is done under the direction and control, and with the full knowledge, of the Canadian producer. The producer must also submit to CAVCO the contract entered into with the individual, outlining the work to be performed and the conditions of employment.

If a non-Canadian showrunner is working on a production, the production will usually not be eligible for the two screenwriter points. See section 6.06 for more information.

The qualified labour expenditure for a Canadian film or video production is the lower of the following two amounts:

The tax credit for a production is equal to 25% of the qualified labour expenditure for the production.

The Part A certificate issued by CAVCO for a production provides estimates of the eligible production cost, the net labour expenditures, and the tax credit Footnote 20 .

Production costs and labour expenditures are verified by CAVCO through its review of the “Financial Information” and “Breakdown of Costs” sections of an application, including attached documents such as the production budget, the audit report and other relevant documents.

A sample tax credit calculation can be found in section 7.08.

CAVCO provides an estimate of the total qualified labour expenditure and tax credit, including for productions for which expenses are incurred in more than one taxation year.

For information on the calculation of the tax credit when expenses are incurred in more than one year, consult the CRA’s guide Canadian Film or Video Production Tax Credit – Guide to Form T1131 , available on the CRA website. The guide also provides additional information on production costs and labour expenditures.

Where two or more Canadian production companies share ownership of a production, only one certificate is issued by CAVCO, with the names of each production company listed. Each company must calculate their respective production costs and labour expenditures to determine their respective tax credits. See section 2.03 for more information on domestic coproductions.

For the purpose of the CPTC, only production costs and labour expenses incurred by the Canadian production company are considered when calculating the tax credit for a production.

The eligible production cost is the cap on a production’s labour expenditures that can be claimed for the purpose of the CPTC. It is equal to 60% of the total production costs, once financing source amounts considered “assistance” are deducted. See section 7.06 for more information on assistance.

Non-deductible expenses (expenses not allowed as business expense deductions, such as certain catering, meal or entertainment expenses) and deferrals Footnote 21 should also be deducted from the total production costs prior to the 60% calculation.

Production costs include all amounts incurred by the production company to create the production, including, but not limited to, development costs, the salary, wages or other remuneration of production personnel, costs for the rental of production equipment, and post-production costs. Production costs do not include expenses related to advertising, distribution or other types of products associated with a production (e.g., a video game, a website, etc.).

In cases where there is more than one final version of a production, one of which is interactive and one of which is linear and non-interactive, only the linear production is eligible for the CPTC. Production costs tied exclusively to an ineligible version of the project need to be removed from all budget and financing documents submitted to CAVCO as part of an application.

The eligible labour expenditures of a qualified corporation for a Canadian film or video production are those meeting the following criteria:

The “net labour expenditures” amount is the total of all eligible labour expenditures (based on the above criteria) minus amounts that are labour deferrals.

Applicants must include the labour expenditure total in their application. In certain circumstances, including pursuant to an internal audit, CAVCO may request additional documentation that reflects how this amount was calculated.

The “production commencement time” is relevant for determining the time frame in which eligible labour expenses must be incurred on a production. It is defined as the earlier of:

Due to the effect of COVID-19 on the Canadian audiovisual sector, the Department of Finance Canada has introduced temporary extensions to various timelines applicable to the CPTC.

Applicants who incurred labour expenses for a production during their taxation year ending in 2020 or 2021 may be eligible to have the production commencement time for the production extended to be as much as three years before the commencement of principal photography.

The labour expenditure of a qualified corporation on a production is equal to the total of the following three types of payments:

Salaries or wages (defined in subsection 248(1) of the Act) must be paid to Canadian citizens or residents of Canada as the latter is defined for taxation purposes. Vacation pay, statutory holiday pay or other taxable benefits may be included as part of this amount. Salaries or wages in this context do not include share option benefits or amounts determined by reference to profits or revenues.

Production companies may consult with their regional CRA Film Services Unit office for further information on which amounts qualify as salary or wages.

Remuneration other than salary or wages is a labour expenditure when it is paid to:

Note that for any type of remuneration to be eligible as a labour expenditure, it must be paid in respect of services rendered by Canadian citizens or by individuals who are residents of Canada for taxation purposes.

Remuneration does not include amounts determined by reference to profits or revenues or an amount to which section 37 of the Act (scientific research and experimental development work) applies.

Producers may consult with their regional CRA Film Services Unit office for further information on which amounts qualify as remuneration.

A production company that is a wholly-owned subsidiary company of another taxable Canadian corporation may, under the terms of a written agreement, reimburse its parent company for labour expenditures incurred by the parent company for a production. These reimbursement amounts have to be amounts that would be eligible under sections 7.05.02 and 7.05.03 (above) if incurred directly by the production company.

Amounts paid to a parent company that do not qualify under this section are treated as payments to another taxable Canadian corporation. See section 7.05.03 b.

Various types of public or private financing may be used to fund a production.

As funding considered “assistance” (see section 7.06.02) affects the estimate of a production’s eligible production cost (and therefore the estimated qualified labour expenditure), CAVCO does not issue a Canadian film or video production certificate until all the components of a production’s financing plan are in place, and copies of all financing agreements have been submitted as part of an application.

Accordingly, a production must be fully financed even at the time of a Part A application. Applicants should list the full amounts of all financing sources for the production, even if they exceed the total production budget when combined.

In applications for treaty coproductions, applicants should only reflect the financing sources that cover the Canadian production company’s production costs.

If a production company is covering more than 15% of the production budget with its own operating funds, additional documentation such as a loan agreement, a financial statement, a shareholder agreement, or a similar form of documentation may be requested by CAVCO.

Assistance refers to any type of production financing received from public or private Canadian or foreign sources, in the form of grants, subsidies, provincial tax credits, forgivable loans or similar types of funding.

Financing received from a federal, provincial, territorial or municipal government entity, including Crown corporations or film agencies, will generally be treated as assistance. This includes funding through provincial tax credits, provincial government grants or equity investments from federal agencies. Note that licence fees received from public broadcasters such as CBC / Radio-Canada or TV Ontario, or licence fee top-ups received from the Canada Media Fund, are not considered assistance.

In addition, funding from a private source will be treated as assistance where it is given in a form such as a grant or a forgivable loan.

Applicants must report any assistance that has been received, or is anticipated, at the time of submitting an application. The CRA, during their review of a CPTC claim, has the final authority to determine whether a source of funding is assistance. Applicants are encouraged to consult the CRA’s Application Policy FMTC 2017-01 for more information on assistance.

CMF funding for a production is considered assistance for the purpose of the tax credit, unless it is in the form of a licence fee top-up. CMF financing agreements indicate funding received as a licence fee contribution (not assistance) and funding received in other forms, including equity investments, repayable advances, recoupable investments or recoupable advances (all considered assistance). CPTC applicants should ensure that the correct types of CMF funding are selected in their application. Footnote 22

If a production is receiving CMF funding, and an amount is entered in the DM Component section (line 85) of the CMF budget, the applicant should ensure that the separate budget provided to the CMF with details of this line item is included with their application to CAVCO.

If the DM Component reflected in line 85 includes any costs ineligible for the CPTC (e.g., for interactive productions, video games, websites, apps, etc.), these costs must be removed from the total budget amount included in the application to CAVCO.

Any CMF financing received in respect of such costs must also be removed from the application. This can be done by proportionately reducing the total of each type of financing the CMF is providing (licence fee top-up and equity investment). For example, if the cost of an ineligible DM component represents 10% of the total production budget, then the amount of equity investment and license fee contribution should also be reduced by 10% each. Note that these amounts will be verified by CAVCO based on documentation provided in the application.

| Total production cost | $1,000,000 |

|---|---|

| Less deferrals, assistance Table 1 note * | - $200,000 |

| Net production cost | $800,000 |

| Maximum % | X 60% |

| Eligible production cost | $480,000 |

e.g. provincial tax credit or grant

| Total labour expenditures | $550,000 |

|---|---|

| Labour deferrals | - $50,000 |

| Net labour expenditures | $500,000 |

The qualified labour expenditure is equal to the lower of the two final numbers: $480,000

The tax credit is equal to the qualified labour expenditure X 25%: $120,000

An audited schedule of production costs is required at the Part B application stage for all productions with a final cost of $500,000 or more. Note that in the case of a treaty coproduction, this cost threshold is by reference to the total costs incurred by the Canadian production company.

The auditor must be a Chartered Professional Accountant in Canada and must be an independent third party not related to the production company.

The auditor’s report must be addressed to the directors of the production company or the producer(s) of the production. The auditor’s name, address and telephone number must be listed and the report must be dated as at the completion of the audit fieldwork.

The audit must be performed in accordance with generally accepted auditing standards and the auditor must be familiar with accounting principles and practices generally recognized in the film and television industry.

Audit reports must include all of the information set out below in sections 7.09.03 to 7.09.05. Reports not conforming to the following guidelines will not be accepted.

The title of the production and, where applicable, the episode numbers, must be indicated. The title of the schedule must indicate the type of costs being reported ("Schedule of Production Costs"). The period during which costs were incurred must also be indicated.

The cost report included as part of a full audit must be in Canadian dollars, and should conform to the line items in the standard Telefilm live action budget template (Excel format) as much as possible.

CAVCO will accept audit results being presented on the appropriate breakdown of costs form available on CAVCO’s website, as long as it is accompanied by the required standard disclosures and explanatory notes.

Only expenditures that were incurred for the specific production can be recorded as production costs, and they must be charged to the proper budget line item.